As therapists, we are required to adhere to an ethical code which states: “Do No Harm.” But what happens when we do and it’s outside of our control?

I still remember the day my client came in my office and said, “I’m really angry with you.” She then told me how she had just been denied life insurance due to a diagnosis I had given her – a diagnosis I was required to give her insurance company so they would pay for her therapy.

The myriad of emotions from that moment are what led me to stop directly billing insurance companies for mental health coverage.

If you are considering using health insurance to cover the cost of counseling or therapy services, you might think twice. Most people think that the cost of therapy is something they can’t manage without using insurance. Most people think of utilizing insurance as a benefit.

However, what they don’t realize is the potential cost of using insurance to pay for counseling.

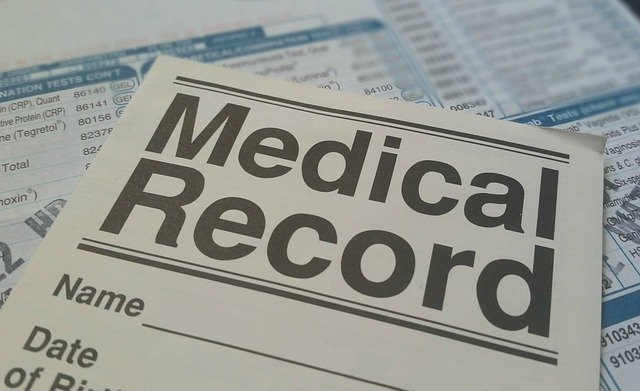

Medical Necessity = On Your Record

Insurance companies only pay for services that are deemed “medically necessary.” In therapy, medical necessity is established by diagnosing a client. Furthermore, as clinicians, we have to demonstrate that a client’s mental health condition is affecting and interfering with their overall functioning on a daily basis in a “clinically significant” manner.

The problem is that many of life’s challenges, and the reasons why people seek counseling, are not mental health disorders, nor are they diagnosable. In this case, your insurance company will not cover treatment. Insurance won’t pay for, “I’m considering divorce and need to talk to someone” or “I feel like an imposter and it’s making me anxious” or “I just lost someone close to me and I need someone to talk to.”

Many people who seek counseling and therapy don’t even have a mental health disorder! They’re just looking to learn skills and strategies to manage and resolve relationship conflicts, increase productivity in their lives or careers, or improve their ability to manage life’s daily stressors.

It’s unethical for a therapist to diagnose you for the sake of insurance payment and it’s considered insurance fraud.

Diagnosis = Possible Long Term Consequences

Mental health diagnoses do not have a statute of limitations. So, the diagnosis stays on your medical record – and in some cases, permanently. Any documented mental health treatment filed through your insurance company will go on your permanent medical record. Therefore it can get flagged as a “pre-existing illness.”

So what?

Well, it’s important to realize this can impact your future ability to obtain services like health insurance. If you’re an entrepreneur or business owner and need financing, your medical record becomes part of the vetting process.

Or in the case of my client – life insurance.

Loss of Confidentiality = Loss of Control

Another concern using insurance for therapy is the loss of confidentiality. In addition to the insurance company requiring a diagnosis, they also gather information about your treatment. This includes notes from each session, treatment plans, goals for therapy, and perhaps the most alarming: “documentation of mental health symptoms deemed clinically significant and interfering with overall functioning.”

How comfortable do you feel with the details of your treatment available for anyone to access, including potential employers?

It’s become a regular occurrence to receive alerts from creditors (and seemingly everyone else) about data breaches. Target, Chase, Yahoo, Equifax, Marriott and the list goes on. These data breaches at major institutions are a regular occurrence.

While some may not care about this, if you hold a security clearance job, or are interested in pursuing a career in the military or government, hold a political position, work in aviation or any type of job that requires health care checks, this is important to know.

The number of institutions now screening employees is on the rise. They’re looking for employees who are “unstable” or “cost too much money” in relation to insurance treatment and lost work days.

Children and teens can have an even tougher time when given a diagnosis as it can impact school, college, or potentially present a barrier to certain careers.

Treatment – Who’s really in charge?

I believe in a strength-based, collaborative approach that focuses on the client, rather than the problem. Furthermore, I believe that change happens when the primary focus of therapy is on the client’s goals for the future, not the pain and discomfort of today.

However, when utilizing insurance to pay for treatment, the insurance company dictates the course of treatment. They set parameters by determining the length of treatment allowed and type of therapy used. They can even discontinue paying for treatment at any time!

Remember what I said in the beginning about the ethical code? Well, included in the Code of Ethics is something called “client abandonment.” If the insurance company suddenly decides they are no longer willing to pay for services (for any number of reasons), what then is the client do?

Coverage…For Now

Sadly, most mental health coverage isn’t even close to what it should be. While many expect this to change down the road, the current political landscape doesn’t suggest it will happen anytime soon.

One of the biggest concerns with coverage and utilizing insurance is that your provider will tell you, “A quote for benefits does not guarantee payment.” Translation: you still may have to pay in full for services provided, after you have received them and your insurance company told you they would pay.

Picture this: you’ve seen your therapist for a few months and suddenly they give you a bill for $1,200 because your insurance company changed their mind and decided after all not to pay for the last 8 sessions.

In the industry, this is referred to as a “claw back.” Nice, huh?

Couples Counseling – How it Really Works

This is where things can get tricky. Some insurance providers claim they offer coverage for couples therapy, but there is more to the story. When your therapist bills for treatment, they use two pieces of information: the type of session and the mental health diagnosis (the medical necessity aspect). However, no billing code exists for couples or marital therapy.

For example: John and Gale come to couples counseling. John and Gale both have the same insurance so one of them becomes the identified client. This person is given the diagnosis. The therapist bills the insurance provider using this diagnosis and the code that indicates “Family therapy with patient present.”

There is another, different type of code (I’ll spare you industry jargon) called, “Problems in Relationship with Spouse or Partner.” However, this code is routinely rejected by insurance companies for not being considered “medically necessary.”

Insurance companies may very well believe couples counseling is a great idea, but they’re just not going to pay for it.

So where does this leave John and Gale and their therapist? Well, let’s say they picked Gale as the “identified client.” This means Gale has to be present for every session, and John can attend as “support” and, according to the insurance company, the focus of treatment should be on Gale’s mental health diagnosis.

But what if Gale doesn’t have a diagnosable mental illness? What if John and Gale are simply dealing with trust issues due to infidelity or they’re grieving the loss of a child and need to learn skills to help support each other?

Here again, we run into ethical considerations for the therapist.

Can you get couples counseling covered by your insurance carrier? As long as one of you has a mental health diagnosis.

The Waiting Game

More often than not, if you are a new patient using an in-network provider, you will likely run into long wait times just to get in to see someone and will have limited flexibility in scheduling. I’ve heard colleagues say they have waiting lists as long as 2-3 months.

Imagine you’ve been struggling for weeks or months and you finally summoned the courage to reach out for help. Then you’re told you have to wait a month to see them! Frustrating, disappointing and potentially harmful.

In most cases, delaying treatment only leads to more severe symptoms and psychological distress.

Bottom line, the earlier you can treat a problem, the better.

Generalist vs Specialist

If you were diagnosed with a rare form of cancer, would you go to your Primary Care Physician for treatment or would you seek the services of the leading Oncologist in your area? The contract between the clinician and the insurance company indicates that the clinician cannot specialize areas of their practice.

For example, in my practice, I focus on stress and anxiety, life transitions, couples, and business professionals. If I were contracted with an insurance company, I would be required to see any and all patients who contacted me – as long as I accept their insurance and have an opening. I wouldn’t be allowed to turn away patients on the basis of their presenting issue if it were outside my specialty areas.

Here again, I refer to the Code of Ethics in which it refers to something called “scope of practice.” Simply put, it is considered unethical for a therapist to practice outside their scope of practice.

For example, if a potential client called and requested an appointment because they were struggling with opioid addiction, I would be required to work with them, per my contract with their insurance company. I’m quite familiar with opioid addiction; however, I do not specialize in this area and I would most certainly be practicing outside the scope of my practice were I to engage in clinical treatment with this client.

Insurance companies are not concerned with scope of practice or specialties. As far as they are concerned, if a clinician is licensed by the state in which they are practicing, the clinician should be able to “manage” common mental health concerns similar to a primary care doctor managing common physical health concerns.

If your teen was addicted to opioids, would you want them to work with a clinician who was going to “manage” their addiction, or a licensed clinician who specialized in addiction and could provide them with resources, tools, and specific skills that could save their life?

Release of Medical Records

For every client that comes to therapy without symptoms that warrant a mental health diagnosis, there are just as many who come to therapy that do. These diagnoses can be anything from Major Depression, Generalized Anxiety, Bipolar Disorder, to Borderline Personality Disorder and Alcohol Dependence.

For clients struggling with these disorders, it often comes as no surprise that the therapist would notate their diagnosis in their record and document treatment methods and their efficacy on the presenting issues.

When you don’t use your insurance, this information remains private. The only person that has access to this information is your therapist – and you, if you wish to view their documentation. When you use your insurance to pay for therapy, your diagnosis, treatments, case notes, and symptoms become a part of your permanent record. It’s not as if you can remove this information after treatment, when you are symptom-free or functioning at a level that no longer requires therapy.

When you apply for new health insurance or life insurance, or sometimes even a job, they can require an authorization to release information to view your medical record. Given the likely changes in the healthcare industry, it is possible that people once again could be denied coverage based on pre-existing conditions, which includes mental health diagnosis. And even if you are able to secure coverage, it may be with a drastically higher premium because of having been previously treated for a mental health diagnosis.

For those that are self-employed (or may ever be unemployed) and need to purchase insurance benefits on the open market, a mental health diagnosis can have a major impact.

Other Considerations & Options

I encourage all my clients to explore and investigate all options to pay for counseling and therapy services in order to make an informed decision. For many, the concerns I’ve outlined above don’t matter and using their insurance is perfectly acceptable.

For others, this is simply not the case.

So what other payment options exist? One option is to use pre-tax dollars. Health Spending Accounts (HSA) and Flexible Spending Accounts (FSA) can be used to pay for therapy. You can also work with an out-of-network provider, which is something I sometimes do for my clients.

What this means is you pay the counselor directly but submit a statement (called a Superbill) to your insurance company. Your insurance company will then directly reimburse you. There are even companies that will do this for you for a small fee such as, Reimbursify.

It’s important to note that the Superbill submitted to the insurance company must contain a mental health diagnosis. If you choose this option, you still are faced with the concern of confidentiality and your medical record, but you choose what therapist you work with, for how long, and both you and the therapist can determine what is the best course of treatment for your concerns, not the insurance company.

Circling Back

Reaching out for help from a therapist can sometimes be tremendously difficult. Therapy is a personal and private process and should be treated as such. I hold my clients’ confidentiality in the highest regard and would never want to put them in a position that could jeopardize their future ability to obtain coverage, service, or even employment.

As for my client I told you about in the beginning? Fortunately, our relationship didn’t suffer because of her denial for life insurance. However, even though she was understanding and forgiving, I still felt terrible. I felt as though I had somehow betrayed her. And I still do.

James Killian, LPC is the Principal Therapist & Owner of Arcadian Counseling in New Haven, CT where they specialize in helping over-thinkers, high achievers, and perfectionists reduce stress, increase fulfillment and enhance performance so they can move From Surviving To Thriving.